Developing financially resilient dairy businesses for the next 10-15 years – what will be the key strategies?

Developing financially resilient dairy businesses for the next 10-15 years – what will be the key strategies?

Presenter: David Beca (Red Sky Agri, Australia)

Online Webinar Format: Registration required to attend (free)

(Please be advised that a PC/Laptop or Tablet using Google Chrome will give best clarity & viewing experience)

Time: 09:00 – 11:00

- 9:00 – 9:15 Sponsor introduction

- 9:15 – 10:05 David Beca presentation

- 10:05 – 10:20 2 x 5min videos plus break

- 10:20 – 10:55 Q&A session

- 10:55 – 11:00 Wrap-up

Webinar 1: What are the three dominant factors that farmers should focus on to increase profit on dairy farms?

28th Oct 2020: Eastern Cape virtual delegates

29th Oct 2020: KZN virtual delegates

Webinar 2: What is the single dominant factor that has driven improvements in profit in South Africa over the last 20 years compared to other countries…and what is South Africa’s ‘Achilles Heel’ limiting profit in the future?

11th Nov 2020: Eastern Cape virtual delegates

12th Nov 2020: KZN virtual delegates

Webinar 3: What are the step-by-step changes a South African pasture-based dairy farmer would need to make to lower their cost of production and increase their profit margin to establish a more financially resilient business?

25th Nov 2020: Eastern Cape virtual delegates

26th Nov 2020: KZN virtual delegates

Bookings need to be confirmed by registering online. NB: Registration closes 23rd Oct 2020. You may elect to register for any Webinar and either virtual location, Eastern Cape or KwaZulu Natal.

Webinar 1 – Presentation outline

- What are the three dominant factors that farmers should focus on to increase profit on dairy farms?

- Which are the essential ratios for dairy farmers to monitor if higher profit is the goal and how do these ratios change when pasture harvest increases, milk production per cow increases, and farm production systems change?

This presentation covers the following areas:

- Confirming the ratios that can be used to describe profit and that should be monitored by dairy farmers to determine the impact of farm management changes on profit

- Reviewing how these ‘profit-monitoring’ ratios change as pasture harvest increases, milk production per cow increases, and farm production systems change through reductions in pasture as a per cent of the cow’s diet

- Developing conclusions from this review as to the three dominant factors that impact on dairy farm profit, which should as a result be the focus for building more financially resilient dairy businesses

SHORT SUMMARY

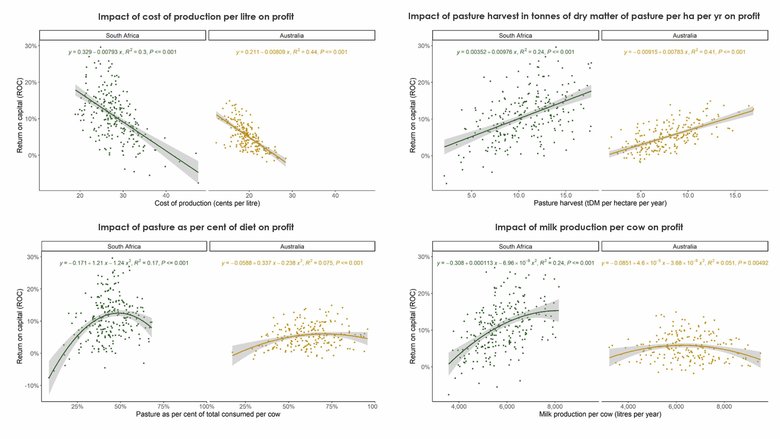

This presentation is based on the analysis of two substantial datasets; 1) 207 Australian dairy farms from a unique unbiased dataset of a single year; and 2) 244 South African dairy farm datasets across 4 years from 2014/15 to 2017/18. Over 140 relationships (ratios) were reviewed to determine what underpins profit in these countries, as well as where there may be differences between the countries. One outcome from the analysis is a list of key ratios that farmers should be monitoring to maximise profit, along with confirming which commonly used ratios farmers should cease to use given they have low utility or no correlation with profit. The presentation also analyses how and why some of the high-level ratios have an impact on profit and business performance. This includes ratios such as pasture harvest, milk production per cow and pasture as a percentage of the total diet. A number of financial and physical ratios are presented including farm size, milk price, milk production per hectare, stocking rate, concentrate and forage price, supplement cost per litre, pasture cost per tDM, labour cost and efficiency, grams concentrate per litre, income over feed costs, milk production per cow as % of liveweight, and more.

A table of essential ‘profit-monitoring’ ratios will be outlined along with the three dominant factors impacting on profit.

Webinar 2 – Presentation outline

- What is the single dominant factor that has driven improvements in profit in South Africa over the last 20 years compared to other countries…and what is South Africa’s ‘Achilles Heel’ limiting profit in the future?

- What more needs to be done to confidently establish the industry’s international competitiveness and provide a potential platform to becoming an exporting country?

This presentation covers the following areas:

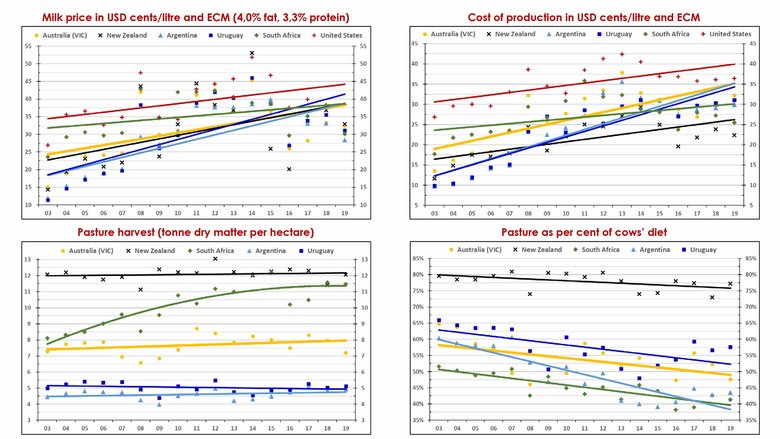

- Comparing trends in the South African dairy industry with New Zealand, Australia, Argentina, Uruguay and United States.

- Analysing South Africa’s strengths and weaknesses, and confirming the dominant factor driving growth for the last 20 years.

- Identifying the major remaining weakness and the strategies required to develop a competitive export milk industry.

SHORT SUMMARY

These country comparisons provide a clear and concise ‘picture’ of what has been happening in these six countries, including which countries are well established to continue to prosper and grow over the next 5-10 years, and which countries are struggling and why. The comparisons between New Zealand as the leading low cost of production industry and United States as the most ‘biologically efficient’ industry provides insights into what the key business principles are that can be adopted by other industries like South Africa. The presentation will outline what might need to change for some countries to recover their international competitiveness, and what all pasture-based countries will need to do to sustain sound levels of profitability and growth. This will include commentary on what ‘strengths’ need to be retained by farmers and what new ‘opportunities’ and ‘threats’ may be imminent. The presentation will identify where the South African industry is strong and more critically, why the dominant factor driving improvements in profit and milk supply growth over the last 15-20 years will not continue in the future. The South African industry’s most significant weakness will be identified and how this could be addressed. In addition, if this were to be addressed, then this would inform the answer to the question “Could South Africa be a competitive milk exporting country” and be an important contributor to the strategy that could make this a reality.

Webinar 3 – Presentation outline

- What are the step-by-step changes a South African pasture-based dairy farmer would need to make to lower their cost of production and increase their profit margin to establish a more financially resilient business?

- What are the challenges and opportunities when changing a production system and including a higher percentage of pasture in the diet?

This presentation covers the following areas:

- Reviewing a model that represents an average pasture-based South African dairy farm

- Reviewing the key assumptions that change as pasture as a per cent of the diet changes, and the impact of these changes

- Developing conclusions as to the impact on profit, cost of production and international competitiveness of the industry

- Discussing the most significant business challenges faced by farmers when they implement a lower cost of production system

SHORT SUMMARY

This presentation outlines the basis for developing a model that represents an average South African pasture-based dairy farm utilising Red Sky benchmark data. Analysis of two substantial Red Sky datasets, one Australian and the other South African, was used to determine how a group of key ratios change as pasture as a per cent of the diet changes. These ratios include pasture harvest per hectare and the following per cow ratios; milk production, animal health, breeding, dairy shed expenses, electricity (excl irrigation), support area expenses, repairs and maintenance, vehicle expenses, labour/staff costs and depreciation. The base model representing an average South African dairy farm has then been progressively developed in four equal increases of 3%-4% of pasture as a per cent of the total diet, with the impact of these changes outlined on all key ratios. A sensitivity analysis has also been completed in relation to milk price, concentrate price and pasture harvest. The presentation reviews the impact on profit and cost of production as pasture increases as a per cent of the diet, and reviews to what degree this could change the position of the South African dairy industry compared to some of the major exporting countries.

The operational and business challenges for a farmer following this strategy are reviewed.

Short bio – David Beca

David started his career in the beef and sheep industry, moving from general farm work to management, and then onto farm ownership with his wife Carlien, and equity partnerships with investors. He then moved into the dairy industry by converting some of the beef land into dairy farms, which subsequently led to him becoming a director of a cooperative dairy company. After this he became a principal in an agricultural consultancy business start-up that developed operations throughout New Zealand, Australia and South Africa. Over this time David developed Red Sky, an agricultural business analysis and benchmarking software application, that had wide use across these three countries. Over the last 10 years he has held leadership positions in large corporate dairy, beef and cropping businesses with operations based in Australia, New Zealand, Uruguay, Chile, Romania, Poland and Russia. This included 3 years living in Uruguay as CEO of publicly listed NZ Farming Systems Uruguay (now Olam Uruguay), and 2 years in Tasmania as CEO of Australia’s largest dairy farming business. David has specialised in the areas of agribusiness management and production systems, including identifying and reporting on the primary drivers of productivity and profitability. He has co-authored a number of scientific and economic papers in Australia and New Zealand, with these largely based on pasture production, farm production systems, and farm business profitability, as well as completing a range of significant projects and benchmarking studies in relation to dairy, beef and sheep production.

Red Sky www.redskyagri.com

David Beca david@redskyagri.com